estate tax exemption 2022 inflation adjustment

Edison Author- ABAs Wills and Estate Administration book New Main Topics. The IRS recently issued the 2022 inflation adjustments for various tax provisions including increased exemption amounts for the estate gift and generation skipping transfer taxes and an increase to the annual exclusion amount for gifts made in the 2022 calendar year.

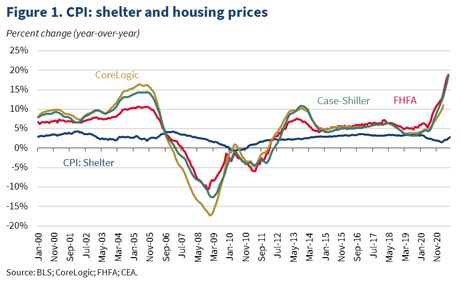

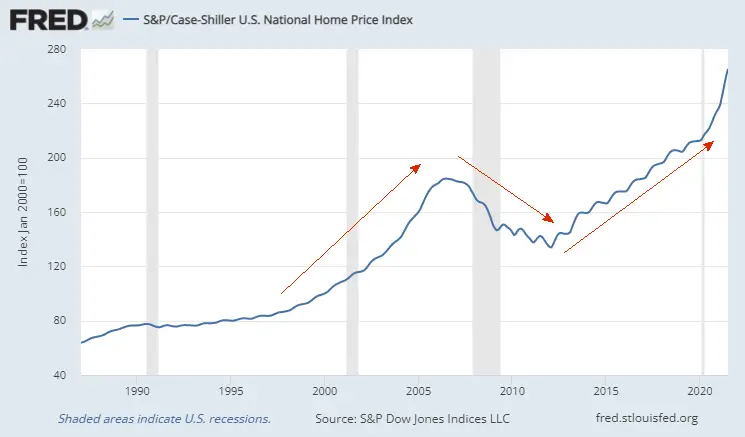

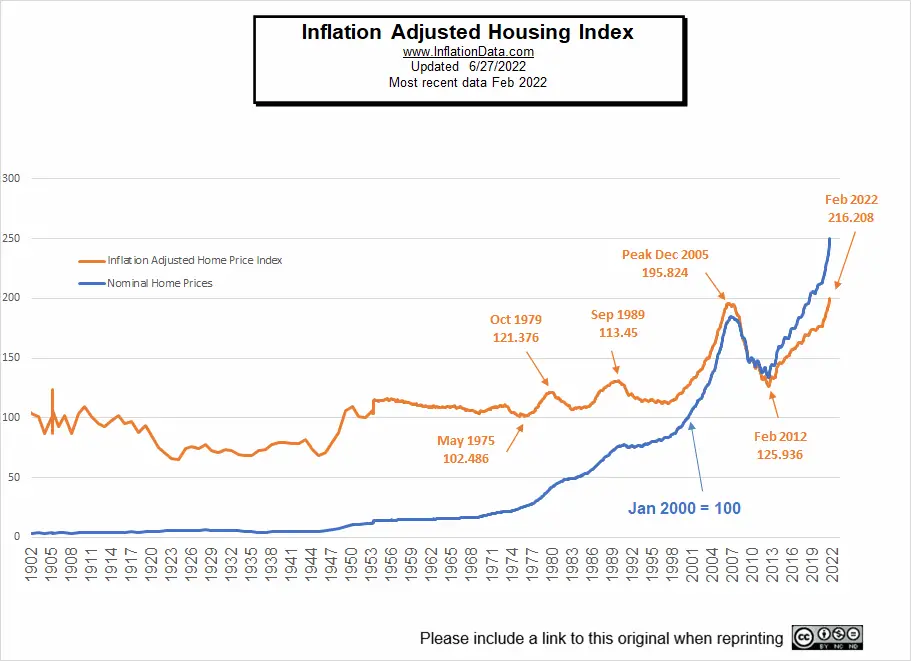

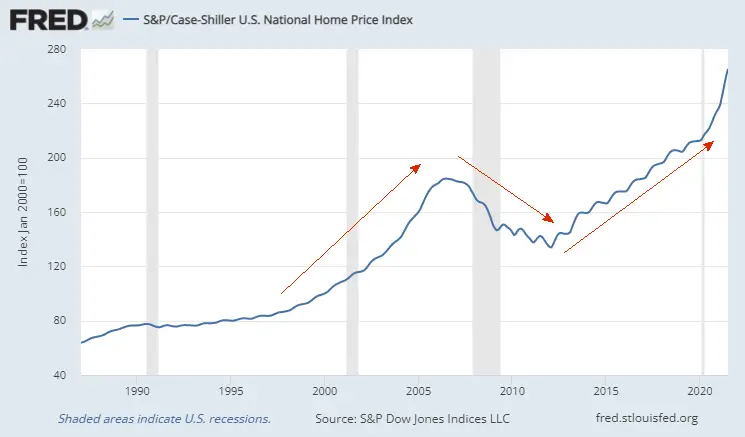

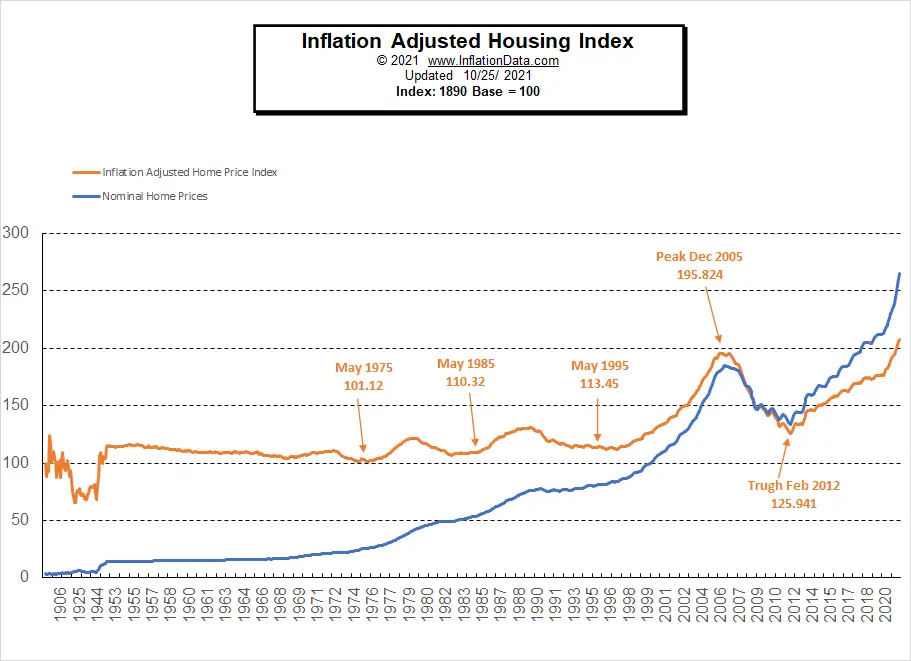

Housing Prices And Inflation The White House

Up to 10 cash back The Inflation Reduction Act of 2022 provides investment in clean energy promotes reductions in carbon emissions and extends popular Affordable Care Act premium reductions.

. In the meantime the new exemption rate decreases the number of estates impacted by this tax from 5000 to approximately 2000. On November 10 2021 the IRS released tax inflation adjustments for 2022. 2022 Annual Adjustments For Tax Provisions.

As this newsletter goes to press the 2022 exemption has not been announcedit was 5930000 in 2021. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. Notably the federal estate and gift tax exemption amount will increase from 117 million to 1206 million beginning January 1 2022.

But its still a big deal when the new exemption is announced each year because theres a lot at stake for certain high-income Americans. These include increased gift estate and generation-skipping transfer tax GST exemptions and annual gift tax exclusions. The federal lifetime gift tax exemption has been indexed for inflation and therefore increased from 11700000 in 2021 to 12060000 in 2022.

2022 Exemptions and Exclusions. What can be done for succeeding generations under the current law is enormous and its at stake. For estates of New Jersey residents who die in 2017 the estate tax is calculated on the amount of.

In 2022 Connecticut estate taxes will range from 116 to 12 wit. However if no action is taken by Congress to change the current law. The gift and estate tax exemption and GST exemption increased to 12060000 for an individual from 11700000 in 2021.

The amount is adjusted each year for inflation so thats not a surprise. It is up to the Contractor to provide the correct exemption certificate to the vendor to save the related sales tax. The estate tax exemption is adjusted for inflation every year.

The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650. West Windsor Township NJ the New Jersey Superior Court Appellate Division ruled that a not-for-profit organization. The Rhode Island estate tax credit amount increases to 70490 in 2022 which effectively increases the estate tax threshold to 1654688 from 69515 and.

The bill is paid for through the implementation of a 15 percent corporate minimum tax budget increases for the Internal Revenue Service to close the tax gap the. 2022 Estate Tax Exemption. The Internal Revenue Service recently released annual inflation adjustments for 2022.

The IRS has released annual inflation adjustments for 2022. Ad Prepare your retirement portfolio to help withstand the insidious effects of inflation. Here are the key figures.

This means that when someone dies and. Estate Planning and Probate 2022. October 19 2022 at 200pm.

The top 37 income tax bracket for estates and trusts will begin at 13450 was 13050. This is a substantial means of compounding estate tax savings. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022.

The changes are as follows. Understand what can cause inflation here. There is a huge opportunity to save 7 on many purchases that were taxed in the past.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Generally when you die your estate is not subject to the federal estate tax if the value of your. Contractors that buy supplies in bulk will benefit.

When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly 65 million. The top 37 income tax bracket for estates and trusts will begin at 13450 was 13050. Since this Bulletin is very recent many vendors may not be aware of this new clarification.

The New York state estate tax exemption increases with inflation each year. The size of the estate tax exemption meant that a mere 01 of. The 2022 generation-skipping transfer tax GST tax exemption amount has also increased to 1206 million per person.

In an interesting recent decision International Schools Services Inc. The annual gift tax exclusion has. They include increased gift estate and generation-skipping transfer GST tax exemptions and annual gift tax exclusions increased retirement account limits and new income tax brackets.

What is the transfer tax exemption for 2022. In addition beginning on January 1 2022 the amount of the federal gift tax annual exclusion the amount a person can give to a. The exemption for married couples is 22800000.

This expanded exemption has a sunset provision which means it will revert back to the 2017 exclusion amount in 2026. The Internal Revenue Service will publish the official inflation adjustments in a Revenue. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual exclusion amount for gifts.

Inflation can be caused by multiple factors. By Kelly Hayes Esq. The estate and gift tax exemption amount has increased from 117 million per person to 1206 million per person in 2022.

Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year 2017 and its scheduled to be repealed entirely effective Jan. Mar 19 2021 With exemption levels being indexed for inflation the exemption amount has gone up still. January 2022 The MLO Minute.

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. Importantly the estate tax exemption is portable. It sat at 114 million for 2019.

Transfer tax exemption for death transfers lifetime gifts and generation-skipping transfers. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The tax rate applicable to transfers above the exemption is currently 40.

The federal estate tax exemption for 2022 is 1206 million. The IRS recently confirmed that for 2022 the aggregate amount that can be given away without being subject to the gift or estate tax will increase to 1206 million per individual. The answer is more complicated for New Jerseys estate tax.

Inflation Adjusted Housing Prices

Why Gas Prices Are So High And What Goes Into The Average Cost Of A Gallon The New York Times

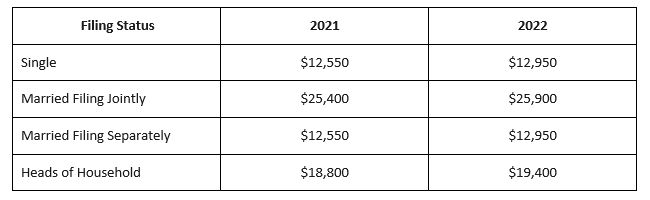

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

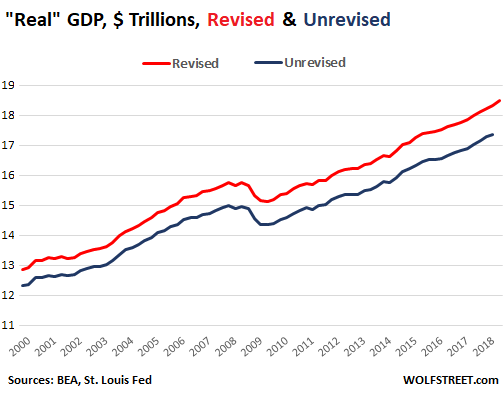

The Big Adjustments In Real Gdp Seeking Alpha

Powell S Fed Set To Go Big And Keep Going Until Inflation Tamed Bloomberg

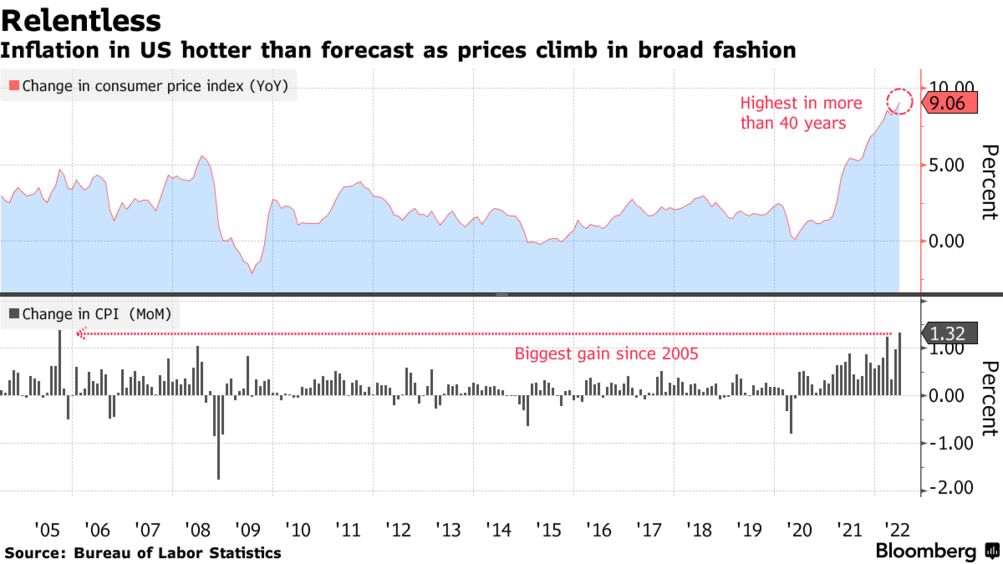

Us Cpi June 2022 Inflation Accelerates To 9 1 Once Again Exceeding Forecasts Bloomberg

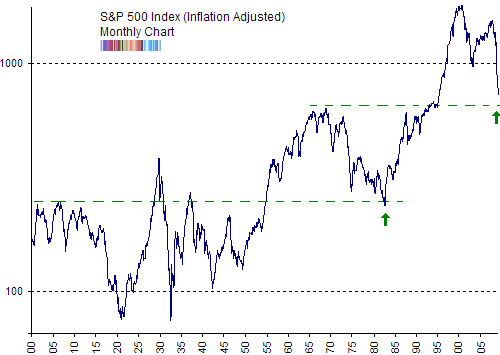

S P 500 Inflation Adjusted Chart Looks A Little Different Seeking Alpha

Median Household Income Growth Deflating The American Dream Dshort Advisor Perspectives

Oc Us Inflation Adjusted Gdp Per Capita Vs Median Income R Dataisbeautiful

Inflation Adjusted Housing Prices

Irs Provides Tax Inflation Adjustments For Tax Year 2022 The Duffey Law Firm

Inflation Adjusted Rate Of Return Definition Formula Study Com

Inflation Adjusted Housing Prices

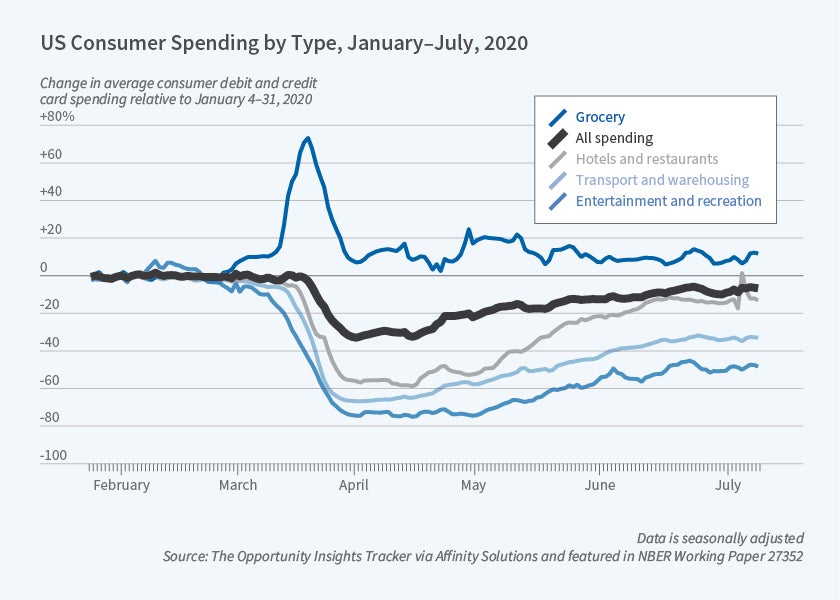

Inflation Measurement In The Era Of Covid 19 Nber

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

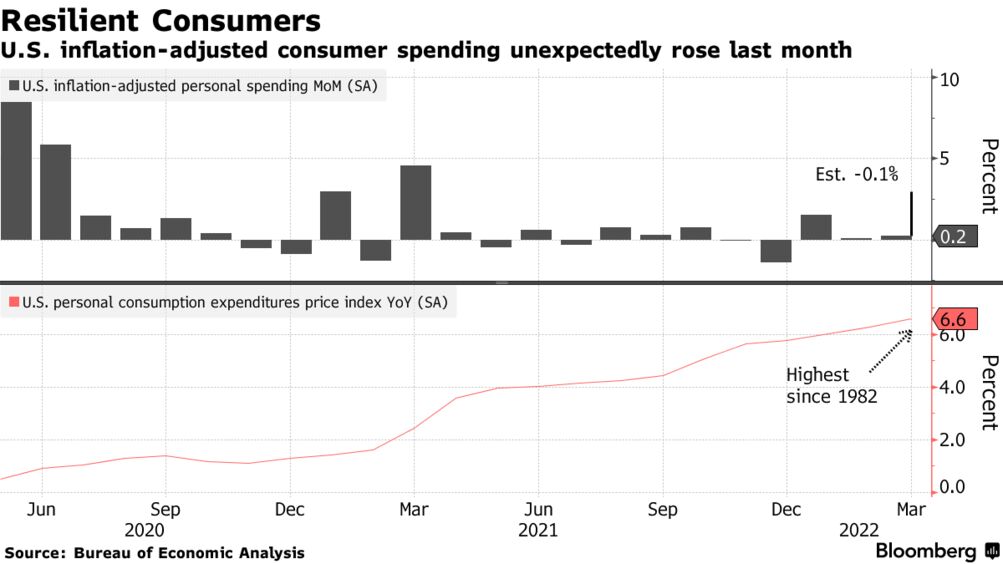

Personal Spending And Trade Improved In April As Inflation Eased